Benefits of Community Banks: Key Takeaways

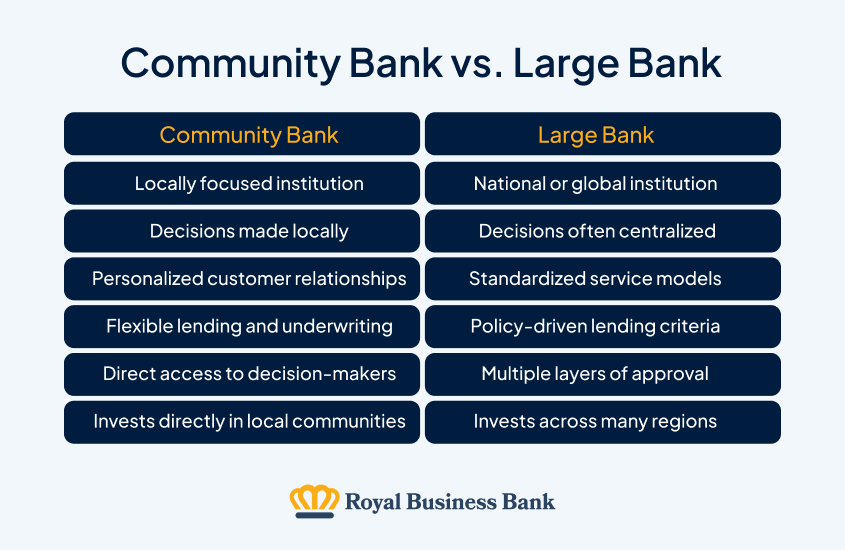

- Community banks offer personalized service, flexible banking solutions, transparency, and faster decisions compared to large banks

- A community bank may be right for you if you’re buying a home, starting a business, rebuilding credit, or simply tired of impersonal service

- When choosing a community bank, look for a strong local reputation, responsive customer service, and financial products that fit your needs

The U.S. banking system includes around 4,600 Federal Deposit Insurance Corporation (FDIC)-insured institutions, including community banking organizations with less than $10 billion in assets and regional banking organizations with total assets between $10 billion and $100 billion.

You may be wondering if a community bank is the right fit, and what sets them apart from larger institutions.

We’ll cover:

- The key benefits of community banks

- How to choose the right one for your needs

- When it makes sense to switch or open an account

Benefits of Community Banks

Acting as the financial backbone for the neighborhoods they serve, community banks offer more than loans. Let’s take a closer look at what they do differently and why it matters to real people.

Personalized Service and Local Decision-Making

Because their teams are part of the same communities (yes, sometimes they even know applicants personally!), community banks take time to understand your individual financial goals and challenges.

This human element can make a big difference for borrowers with unique situations, such as self-employed individuals or new immigrants.

Let’s say you’re applying for a loan as a first-time homebuyer or a new business owner. A local bank will take the time to get to know you, consider your full financial picture and clearly explain what you qualify for and why.

Rather, they’ll consider your full financial picture. Plus, you’ll be able to speak directly to decision-makers, speeding up the decision so you can move forward with your goals.

Services That Reflect Local Priorities

Unlike larger banks that offer one-size-fits-all products, community banks design their services with local customers in mind.

That means more flexible personal and business banking options built around your real-life needs, so individuals and businesses in the community can thrive.

For example, you’ll be able to access:

- Mortgage loans with alternative documentation options for self-employed or foreign national borrowers

- SBA and commercial real estate loans designed to grow your small business

- Personal checking, savings, and certificate of deposit accounts, especially for those new to the U.S. financial system

A Transparent Approach to Banking

One of the key advantages of community banks is their commitment to transparency.

You won’t find surprise fees or vague rules. You’ll get:

- An honest conversation about what you qualify for and why

- Clear explanations of loan terms

- Upfront information about costs, terms, and expectations

Accessibility: Online and In Person

Forget about long wait times and automated phone menus that lead nowhere. At a community bank, you can walk into a local branch and speak with someone who knows your name and challenges.

Or access your community bank’s services through mobile banking apps to transfer money online and deposit checks remotely.

Want more? You can follow up with real human support whenever you need it.

Investment in Local Communities

Community banks want to make a difference. That’s why they reinvest in the areas they serve.

This can happen through loans to local businesses, partnerships with nonprofits, or sponsorships of neighborhood events.

Think about it like this: A community bank might approve a loan for a new daycare center or fund an apartment renovation project that helps improve a neighborhood, opportunities that may be ignored by national banks that focus on larger markets.

Financial Education

Community banks prioritize education, helping clients understand credit, loans, and savings.

New to banking and U.S. financial systems? Community bankers are more likely to walk you through the process with patience and translate complex finance terms into a simple language.

They also tend to offer more transparent pricing, fewer surprise fees, and better explanations of terms.

When To Consider a Community Bank

While you may decide to use community bank services at any point in your life journey, there are key moments when choosing one makes the most sense.

Buying Your First Home

If you’re navigating the homebuying process for the first time, a community bank can be your best ally.

They’ll walk you through the steps and be more flexible with credit history, income documentation, and loan structures.

Starting or Growing a Small Business

Need a loan to launch a new venture?

Backed by local knowledge and understanding of your market, community banks offer small business lending, paired up with quicker approvals.

Moving to a New Area

If you’re relocating, a community bank can help you connect with everything you may need, offering connections to local services, customized account setups, and even advice on building credit or financing your new home.

Rebuilding or Establishing Credit

Are you recovering from past financial challenges or just starting to build your credit history?

Community banks offer secured credit cards, starter loans, or coaching to help you reach your financial goals.

Feeling Overwhelmed by Impersonal Banking

Forget long wait times, generic service when you feel just like an account number, confusing policies, or being bounced between departments.

Switching to a community bank means you’ll talk to people who prioritize your needs and are invested in your success.

Finding the Right Fit: What To Look for in a Community Bank

Although community banks offer many advantages, not all are created equal. Here’s what to look for when deciding where to bank:

Consider Their Story and Reputation

Research how long the bank has served your community. Look for testimonials and recognition from local organizations.

Check out their website for information on local investment and community involvement initiatives.

Look at Their Product Offerings

Start by identifying what you really need, whether a personal checking account, a mortgage, or support for growing your business.

Check to see if the bank offers products that meet your goals, including flexible underwriting, niche business loans or digital tools like mobile apps and online banking.

Evaluate Customer Service

Yes, you read it right. Visit a branch or give them a call to see how they make you feel.

If they’re friendly and responsive, listen to your story and take the time to explain products, this may be your bank.

Also, check to see if they have digital tools, such as mobile apps and online banking, that meet your expectations.

Meet With a Banker

If you’re making a major financial decision, schedule an appointment with a banker. Are they trying to grasp your full financial picture? Do they suggest solutions to your challenges?

Their willingness to listen and offer customized solutions will help you decide if you want to become a client.

Looking for a Community Bank? Meet Royal Business Bank

Founded in 2008 to offer financial services to first‑generation Chinese and Taiwanese communities, Royal Business Bank’s services were rooted in deep cultural understanding.

Over the years, it has grown into a trusted community bank with branches across six states, welcoming more people while honoring its original mission.

Today, Royal Business Bank supports individuals and businesses of all backgrounds, providing a full range of community banking services, from personal checking and savings to commercial lending, mortgage solutions, and digital banking tools.

Giving back is a key part of the bank’s identity. We partner with more than 60 local organizations to support initiatives such as free tax preparation for low-to-moderate-income families, financial literacy workshops, and food and toy drives, aiming to make our community stronger.

Benefits of Community Banks: FAQs

What is a community bank?

A community bank is a locally focused financial institution that offers personalized service, makes decisions locally, and reinvests in the communities it serves.

Are community banks safe?

Yes. Like all FDIC-insured institutions, Royal Business Bank protects your deposits up to the federal limit, so your money is safe and secure.

Do community banks offer mobile banking?

They do. At Royal Business Bank, you’ll find mobile check deposit, online banking, and other tools that let you manage your money from anywhere, whether you’re at home or on the go.

Can a community bank help with a mortgage or business loan?

Of course. At Royal Business Bank, we take time to understand your full financial picture and offer custom solutions based on your specific needs.

How do I switch to a community bank?

Switching is easier than you might think. Start by opening your new account, then our team will help you move over your direct deposits, bill payments, and anything else you need to ensure a smooth transition.

All loan requests are subject to credit approval.

The articles contained on the Bank’s website are strictly for educational and informational purposes only and are not intended as financial or investment advice or as an endorsement of any products or companies listed.

Royal Business Bank and/or its affiliates assume absolutely no liability for any losses or damages that may result from a reliance on the reference materials. In addition, the materials are not updated and may not be current. Please consult with your own financial professional(s) to discuss your own unique situation regarding the article contents.