Stablecoin & Other Cryptocurrencies: Key Takeaways

- Stablecoins are digital currencies with a steady value, “pegged” to real-world assets

- Unlike other cryptocurrencies, their value doesn’t change compared to the pegged government-issued currency, and they can be used in everyday activities like sending money or making payments

- There are different types of stablecoins including fiat-backed, crypto-backed, and algorithmic method to keep values stable

- Stablecoin transfers are faster than traditional bank transfers and can move money 24/7 without delays on weekends or holidays

- They usually have lower fees because there are no middlemen like banks or wire services involved in the transaction

- Despite being a fast and easy payment tool, stablecoins come with risks like lack of transparency, technical issues, and regulatory changes, so it’s important to choose carefully

In just one year, the total value of stablecoins in circulation grew by 75%, reaching $300 billion in September 2025.

Although the word “stablecoin” might sound like yet another buzzword in the crypto space, there’s a practical reason the cryptocurrencies have caught on so quickly.

In this article, we’ll break it down in simple terms and cover:

- What a stablecoin is and how it works

- The different types of stablecoins

- How stablecoins compare to other cryptocurrencies

- Common risks and regulation updates

Stablecoins Explained

Think of stablecoins as the calm cousins of Bitcoin: still digital, still fast-moving, but without the rollercoaster prices.

A stablecoin like USDT aims to stay around $1, and this is achieved by linking, or “pegging,” it to a stable asset like the U.S. dollar, the Euro, or even gold.

That’s the whole point: The value is meant to stay steady, hence the “stable” label.

This predictability is practical because people don’t have to worry about a sudden drop in value when they’re sending money, making purchases, or saving.

Stablecoins are usually issued by private companies, such as fintech or crypto firms, that create and manage the coins.

These companies are responsible for backing each stablecoin with the promised asset and keeping the system transparent and trustworthy.

Types of Stablecoins

Not all stablecoins are built the same. Some rely on dollars in the bank, others on crypto reserves, or even computer code.

Fiat-Collateralized Stablecoins

The most common and widely used stablecoins are backed by real money. This means that for every stablecoin issued, there’s real money held in a bank account as backup.

Let’s say a company issues 1 million stablecoins. In this case, it should have $1 million sitting in reserve.

Popular examples include USD Coin (USDC), with $76.05 billion in circulation and Tether (USDT) with 187 billion USDT (Tether) tokens.

Crypto-Backed Stablecoins

Stablecoins can also be backed by other cryptocurrencies such as Bitcoin or Ethereum. Since crypto prices can change a lot, the companies usually hold extra value to keep their price stable.

For example, if a company issues $1 worth of stablecoins, it may hold $1.50 in another crypto like Ethereum in its reserves.

One such stablecoin is DAI, which holds in reserve smart contracts and excess cryptocurrency.

Algorithmic Stablecoins

Instead of relying on actual reserve money, stablecoins controlled by algorithms use software to manage the supply of coins.

Just as smart thermostats adjust the temperature in your home using a simple algorithmic program, algorithms create more coins if the price goes above $1 or remove coins from circulation if the value drops below $1.

How Do Stablecoins Differ From Other Cryptocurrencies?

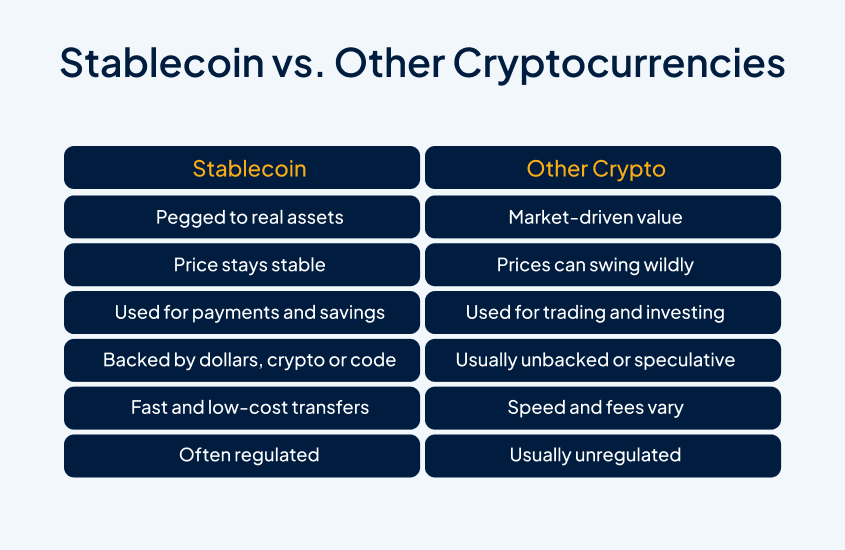

Like other cryptocurrencies, stablecoins are digital, use blockchain technology, and can be stored in a crypto wallet, but they are distinctly different.

Price Stability

Designed to hold a steady value by being pegged to a real-world asset like the U.S. dollar, stablecoins have a price that is not affected by supply, demand, news, or investor speculation.

Unlike Bitcoin’s wild price swings, stablecoins offer predictability without dramatic peaks and valleys.

Purpose

As a digital version of cash, stablecoins can be used for everyday payments, remittances, saving, or trading.

Other cryptocurrencies often serve as investments or have specific functions like paying transaction fees or powering smart contracts, but they are less useful for paying bills and doing the other things we accomplish with money.

Backing and Value Source

While the value of traditional cryptocurrencies like Bitcoin is determined purely by what people are willing to pay, stablecoins’ value is protected by real assets or algorithms that regulate supply.

Regulation and Trust

Stablecoins are under regulatory scrutiny, especially those backed by fiat currency. Some providers publish regular audits of their reserves to build trust.

Other cryptocurrencies are often decentralized and unregulated, increasing the risk for investors and new users.

How Does Stablecoin Work for Payments and Transfers?

Want to send money to a family member for their birthday or transfer funds to a business overseas? Stablecoins make the payment process simple and fast.

Faster Than Traditional Bank Transfers

While an international bank transfer can take days going through multiple banks and systems, with stablecoins you move money instantly.

No weekend or holiday delays. Blockchain technology runs 24/7, so your payment is processed anytime without needing a bank to be open.

Lower Fees

International wire transfers and remittances are costly. This can be challenging for freelancers working with clients in other countries or small businesses that need save every dollar they can.

With no middlemen to handle transactions, stablecoins are moved automatically, which means fewer fees, often just a few cents.

No Need for Full Bank Access

If you live in an area where there’s no easy access to banks, stablecoins allow you to send and receive digital dollars even without a bank account. All you need is a smartphone and internet connection.

Ideal for Digital Commerce and Smart Contracts

Stablecoins also work well in online platforms, e-commerce, and automated systems.

If you work with automated digital agreements, stablecoins allow you to pay vendors the moment a delivery is confirmed, cutting down on paperwork and delays.

Stablecoin Credit Cards

Using a stablecoin credit card, you can spend digital dollars just like you would with a regular bank card.

Instead of using traditional cash or points, these debit cards let you pay with stablecoins online or in-store, earn rewards, and track your spending, an easy way of bringing crypto into everyday life.

Stablecoin Wallet

Like a banking app, a stablecoin wallet lets you store, send, and receive stablecoins safely.

No physical wallet is needed. Your account is on the blockchain, and you can access it with your wallet. Your stablecoins are as near as your phone or computer, ready to buy coffee, split a dinner bill, or set aside money for next month’s rent.

Stablecoin Regulation and Risks

As a new monetary space, stablecoins call for regulatory mechanisms by governments around the world. U.S. regulators focus on:

- Making sure companies have enough assets to back their coins

- Protecting consumers from fraud or mismanagement

- Monitoring and prevention of stablecoin use for illegal activity

Even though stablecoins aim to be steady, there are still risks to consider:

- Lack of transparency: If a company doesn’t show how it backs its coins, your funds could be at risk.

- Technical issues: If a platform has bugs or your wallet is hacked, you could lose access to your funds.

- Regulatory changes: New laws could affect how you use or access stablecoins in the future.

Understand the Future of Money With Royal Business Bank

At Royal Business Bank, we believe in educating people about traditional and new financial tools and emerging trends like stablecoins.

The aim is to help people like you make the best decisions when it comes to money.

At the same time, we continue to provide reliable, relationship-based personal and business banking services our customers count on. These include:

- Residential lending solutions, such as asset utilization mortgage loans and portfolio mortgage loans

- Commercial lending solutions, including construction loans, SBA loans, and commercial real estate loans

- International banking

In a fast-changing world, our mission remains the same as the day Royal Business Bank was funded: to provide banking services that move at your speed.

FAQs About Stablecoin

Are stablecoins safe to use?

The safest stablecoins are backed by real cash held in a regulated bank and are transparent about their reserves. Like any financial tool, it’s important to research who’s behind it and how it’s secured.

What can I use stablecoins for?

You can use stablecoins to send money quickly, make online purchases, store digital savings, or even earn rewards.

Can I use stablecoins without being a crypto expert?

Surprisingly, yes. All you need is a digital wallet that can hold, send, and receive them.

How do stablecoins stay at $1?

Stablecoins stay at or near the target value by being backed by assets like dollars, crypto, or smart algorithms that control supply and demand. The most stable ones keep real-world funds in a bank account equivalent to the total value of coins they have issued.

Royal Business Bank does not offer cryptocurrency products or services. Please note that cryptocurrencies are NOT FDIC‑insured, may incur losses, may lose value, and there are no bank guarantees against losses.

The articles contained on the Bank’s website are strictly for educational and informational purposes only and are not intended as financial or investment advice or as an endorsement of any products or companies listed.

Royal Business Bank and/or its affiliates assume absolutely no liability for any losses or damages that may result from a reliance on the reference materials. In addition, the materials are not updated and may not be current. Please consult with your own financial professional(s) to discuss your own unique situation regarding the article contents.